MORTGAGE CONSULTANTS YOU CAN TRUST. SERVICE YOU CAN COUNT ON.

City Bank's online borrowing experience together with industry-leading customer service makes it easy to get the loan your deserve for the home you'll love.

Now is the time to buy. Start your application today!

Low-rate mortgage options

that make for happy borrowers

From conventional loans to second home purchases and investment opportunities, we have a better borrowing experience for your next purchase or refinance.

Conventional

This option is typically fixed in its terms and rates so there isn’t a need to worry about rising interest rates. It is not guaranteed or insured by any government agency.

VA

VA loans are available to United States Veterans and Active Service Members. They are guaranteed by the Department of Veterans Affairs (VA). No down-payment is required with a VA loan.

FHA

FHA loans are typically the loan type best suited for first-time homebuyers. They are insured by the Federal Housing Administration (FHA) and have a low down-payment requirement.

USDA

USDA loans are offered through the United States Department of Agriculture. These loans are specific for those residing in rural areas. There is no down-payment requirement.

Jumbo

This option is for a loan of a larger amount that exceeds the conforming loan limit threshold.

Refinance

Pay off one loan with the proceeds of a new loan when you refinance. It can help lower monthly payments, get cash out, or possibly lower your interest rate.

Loan approval is subject to credit and property approval and program guidelines. Other restrictions apply. Not all loan programs are available in all states for all loan amounts. Interest rates and program terms are subject to change without notice. If your down payment is less than 20 percent of the home’s purchase price, mortgage insurance may apply. If subject property is located in a special flood hazard area, flood insurance may apply. Homeowners insurance and property taxes may be reserved in an escrow account and allocated each year. Taxes, insurance, and any other potential fees are not determined until an application is submitted and a property is identified. The monthly escrow items are 1/12 of the actual amount and do not include a cushion. Other fees may apply.

A better online mortgage experience

Our application process that makes the home-buying process easy from start to close.

This best-in-class experience allows you to complete an application by answering a few simple questions along a guided path. Gathering the necessary financial documentation is done by simply connecting with your bank's website and importing information—all through a secure environment. Plus, you can heed the relationship advice with real, local lenders to assist at any point in the process.

Whether you’re applying on the go or at home, we're delivering the best borrowing experience with the best possible rate to get you in the home you deserve with a payment you’ll love. This is how home buying was meant to be.

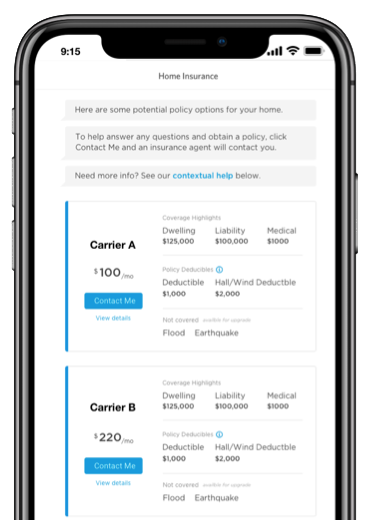

Integrated insurance policy estimates*

Instantly receive quotes and access multiple quotes—right from the online application process. We've simplified the way you shop for insurance. After you apply, you can now receive quotes for your policy based on the information you submit when completing an application. It's the perfect solution to save you time, money, and the hassle of shopping for a policy.

Start your application today!

Our best-in-class online borrowing experience makes it easy to apply for your home loan in just a few simple steps.

Apply Now

Not ready to fill out an application or have questions? Give us a call today.

1 (800) 687-2265

Home insurance policy purchasing is a service to help you shop for insurance more easily. City Bank is not affiliated with any insurance provider and we do not endorse any insurance provider. Borrowers are not required to get a policy through any of the providers they may encounter during City Bank's application process and can get insurance from any carrier of the borrowers choosing. The borrower's Social Security number is not transmitted or shared with carriers.